1. T-Mobile’s CFO Forecasts Closing Merger In Q2 2019.

The FCC is expected to complete their examination of the proposed T-Mobile Sprint merger within the next six months. T-Mobile is forecasting to close the merger in the second quarter of 2019. This is according to the CFO and EVP of T-Mobile, Braxton Carter, who spoke two weeks ago at the Morgan Stanley Annual Technology, Media & Telecom Conference in Barcelona.

2. Sprint CEO and Softbank CEO Are Leaving Kansas City.

The CEOs of Sprint and Softbank, Sprint’s parent company, both put their houses up for sale in Kansas City a few weeks ago. Kansas City, more specifically Overland Park which sits about 10 miles south-west of Kansas City, is the headquarters for Sprint. If you have $10M burning a hole in your pocket, you can pick up the CEO’s French chateau-style estate.

3. Sprint’s 4M SF Campus Headquarters In Kansas City Is For Sale.

Sprint has their entire four million-square-foot headquarters up for sale with plans to lease-back only a portion of the campus. Many of Sprint’s buildings currently sit vacant or are leased to other tenants.

Sprint has continued to downsize their workforce over the years, with the most recent layoff announced back in March. According to the Communications Works of America labor union, the proposed merger of Sprint and T-Mobile would result in the loss of 28,000 jobs across the nation.

4. Sprint Is Not Renewing Cell Site Leases with Rent Increases.

On the dozens of Sprint leases we have that are up for renewal, Sprint has not agreed to increase the rent in exchange for an additional term. Instead our clients have been moving Sprint to month-to-month tenancy and increasing their rent with written notice. This is an option available to many landlords throughout the country. Please give us a call if you would like to discuss further.

5. Wall Street Is Bullish On Sprint-T-Mobile Merger.

Sprint’s stock is up 18% in the last six months and has held steady around $6.00 per a share for the last three months. Many analysts believe the value of the merger being approved is already baked into the stock’s current price. If the proposed merger were to fail, you can expect an immediate hair-cut on Sprint’s stock price. The typical market back-lash to a failed merger. Although this merger, in our opinion, has a high probability of going through.

6. Buyers Of Cell Site Leases Have Stopped Buying Sprint Contracts.

On behalf of landlords, I sell millions of dollars in cell site lease contracts every year. Within the last few months buyers across the country have stopped buying Sprint contracts altogether. Investors view Sprint contracts as a high-risk for termination and there are lower-risk investment opportunities currently on the market. If you still have a Sprint cell tower lease and you did not sell within recent years, just hold the contract and hope the merger falls through.

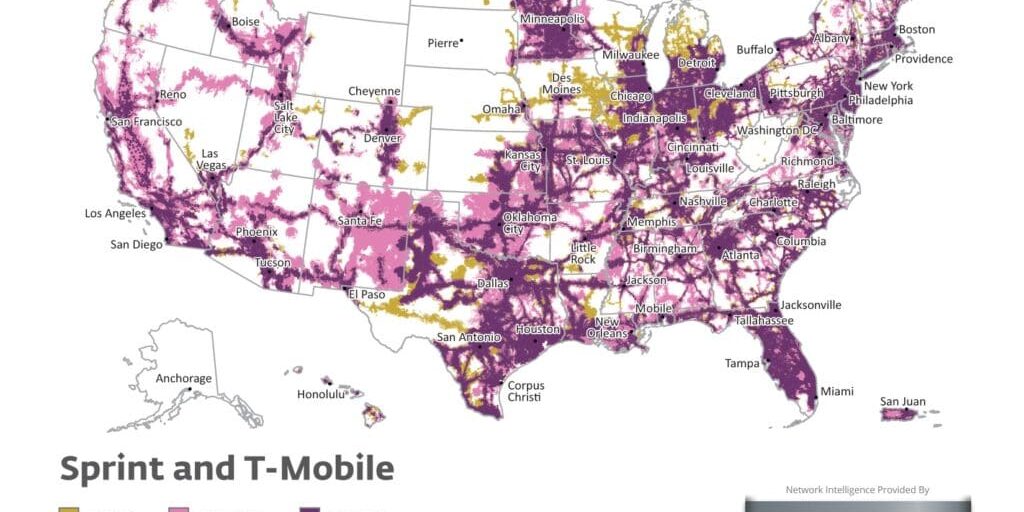

7. 35,000 Sprint Sites Are On The Chopping Block.

If the merger is approved, it is forecasted that it will take at least three years to decommission Sprint’s cell site network, approximately 35,000 sites, and the merged entity will use T-Mobile’s network as their anchor. This means if you have a Sprint cell site or cell tower lease, the contract should pay you rent for the next few years and then they will terminate when it is time to decommission the site.

Have A Cell Tower Lease Question?

Call Us Today

(888) 443-5101

Posts That May Interest You:

Related Articles

2 Comments

Leave a Comment

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).

Hello,

I have a sprint cell site at [address removed]. Their lease expires in [date removed]. Let me know if there is anything that I should be doing to prepare for the merger.

Thank You,

Steve

Hi Steve,

We are working on a high volume of lease renewals at the moment. Please give us a call at (888) 443-5101 and we can discuss your lease.

All the best,

Nick G. Foster