A question we frequently receive is, “How will I be impacted by the Sprint T-Mobile merger?”. Before we answer that question, let’s find out how did we get here.

How & Why Did The Merger Start?

In 2018 Softbank, Sprint’s majority owner, reached an agreement to buy T-Mobile. Any merger would require the review and approval of the Department of Justice (DOJ) and the Federal Communications Commission (FCC). The DOJ would look at antitrust concerns while the FCC would be concerned with what is best for the US consumer. It was speculated at the time that the Sprint brand would disappear and T-Mobile’s brand and flamboyant CEO John Legere would be in charge post merger. We now know that John Legere is retiring, maybe riding off into the sunset to write more cooking books.

Sprint T-Mobile Faced Legal Challenges To Get Here

It was announced in February 2020 by Federal Judge Victor Marrero the United States District Court in Manhattan that Judge Marrero has ruled in favor of T-Mobile’s then valued $26 billion takeover of Sprint.

The challenge against the merger was filed in a suit by attorney generals from 13 states and the District of Columbia. This ruling will combine the third and fourth largest wireless carriers creating a new wireless carrier with more than 100 million users.

After the merger is complete the plan was that the majority of Sprint customers will have T-Mobile plans. Customers of Sprint’s pre-paid brands (Boost Mobile, Virgin Mobile, and Sprint prepaid), will become Dish Network customers.

Sprint T-Mobile Merger Closes $30 Billion Deal

T-Mobile and Sprint announced the closing of their merger on April 1, 2020. The colorful T-Mobile CEO John Legere stepped down as CEO and the more buttoned-up Mike Sievert took the helm of the combined company. The company uses the name T-Mobile moving forward and now has approximately 100 million customers. This allowed T-Mobile to surpass AT&T as the number two largest wireless provider.

T-Mobile agreed to enter into a limited seven year term deal with Dish to lease Dish access to its network. This is supposed to give Dish time to build its own network, however, many skeptics believe Dish will coast on their limited-term deal and then sell of their spectrum holdings in the future for a profit. Skeptics further believe Dish never has any intentions of truly building a new wireless network.

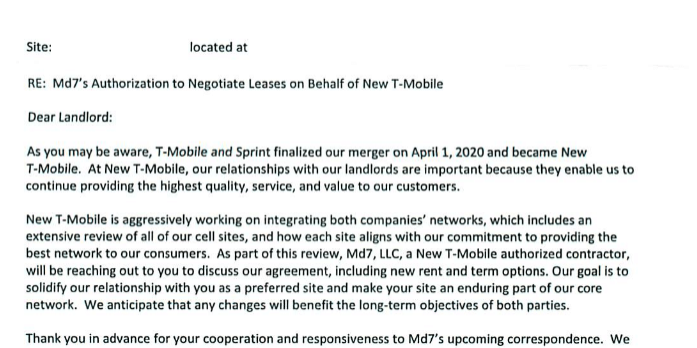

What Does That Mean For Sprint & T-Mobile Landlords?

We have seen a slow-down in T-Mobile leasing activity while they figure out their new network, but not a complete stop. Some projects have grind to a halt, however at Airwave Advisors we have managed to get some lease renewals completed with the new combined entity.

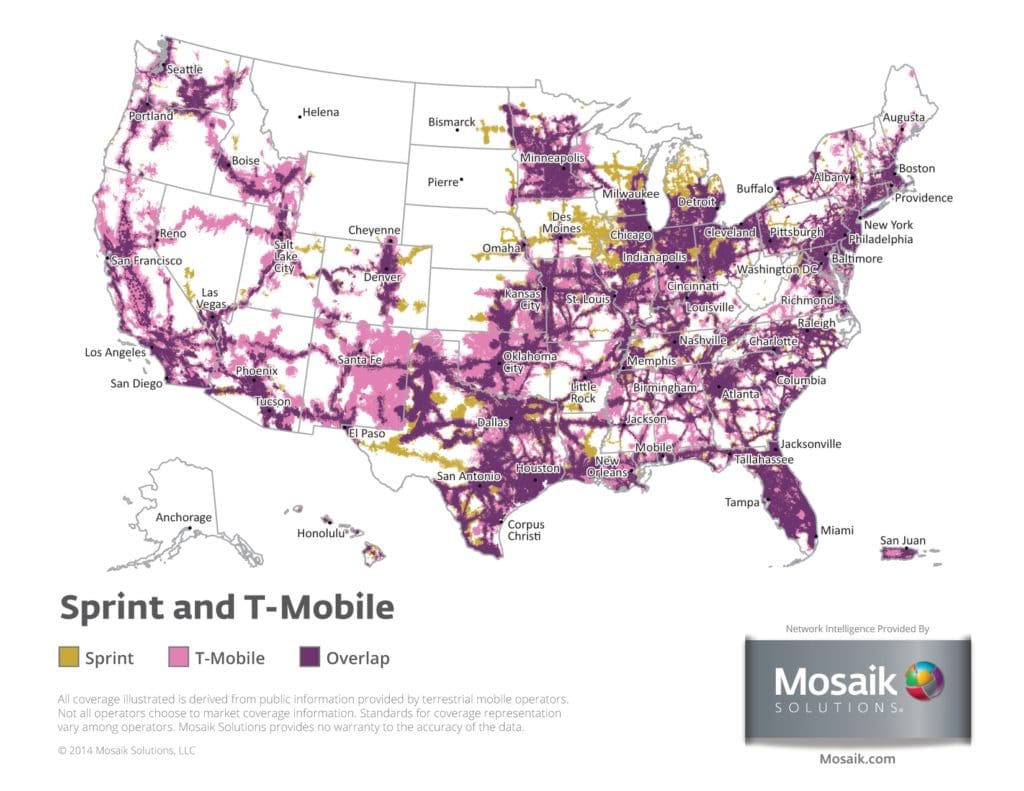

In 2018 it was forecasted that the merger between T-Mobile and Sprint, who operate a total of 110,000 towers, would cause the companies to shut down 35,000 towers and build 10,000 new towers. This would be due to overlapping coverage of towers due to the merger and the filling of holes in the network.

It is anticipated that Crown Castle who receives 20% of their tower revenues from T-Mobile and 13% of their tower revenues from Sprint will be hurt the most with the merger.

Crown Castle’s top competitor American Tower Corporation on the other hand has less exposure to the merger with T-Mobile representing 9% of their US based revenue and Sprint representing 8%.

As far as private landlords, we anticipate there will be many site decommissions and rents will stop coming in within the next 36 months.

If you have both Sprint and T-Mobile on your property there is a chance that one these tenants will disappear. If they say a picture is worth a thousands words then the one below of network overlap in T-Mobile & Sprint’s network from Mosaik reads like a book.

What Is The Process To Determine A Decomission?

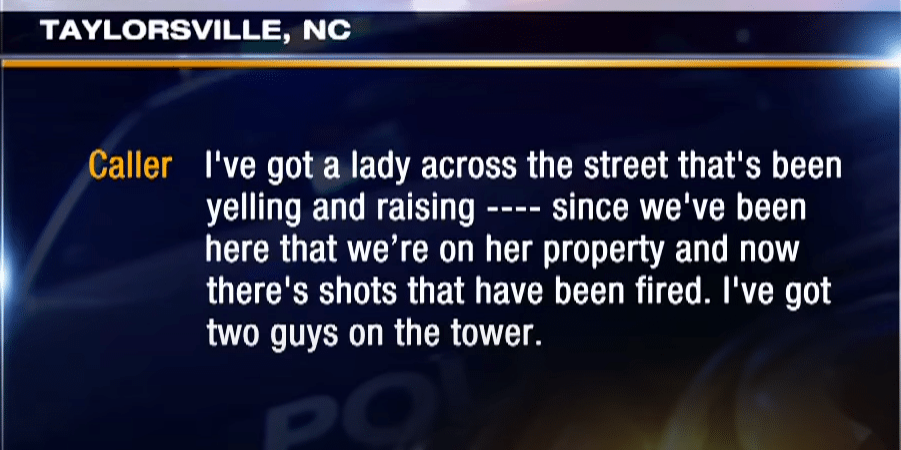

Right now we are seeing T-Mobile evaluate all the Sprint sites and the ones they do not want to keep they are offering up to DISH. DISH can then decide if they want to take on that cell site, or if they want to pass. Only after a site has been passed over by both T-Mobile & DISH will the site be determined not of value to either network and decommissioned.

Do You Have A T-Mobile or Sprint Question?

Give Us a Call Today

(888) 443-5101

Related Articles

18 Comments

Leave a Comment

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).

Hello, how do I find out if my SPRINT tower is scheduled for decommissioning? I would really like to plan ahead.

Regards,

Kevin

Hi Kevin,

In past decommissions from other carriers, the carrier hires a third party to contact the property owner to negotiate leaving everything on the property in exchange for a one-time payment that is less than their decommission costs of the site. Once you receive that contact you will know you are scheduled for decommission.

All the best,

Nick G. Foster

I am a property owner In Los Angels County with a singe tower which was originally constructed by Sprint. During the construction of the tower, T-mobile agreed to lease space on the tower from Sprint and ground space from me. Several years ago Sprint sold the tower to SBA communications.

I collect a check from SBA for the Sprint side of the tower along with the ground space rent

I collect a check from SBA for a percentage of T-Mobiles rent paid to SBA

I collect a check from T-mobile for the ground space they rent.

Any advise would be appreciated

Hi Grant,

Everything sounds great. I would just treat the rent as if it will not be around forever, in case the Sprint rent checks stop coming in. Other than that great work!

All the best,

Nick G. Foster

My tower is located just off I-45 north of Huntsville, Tx. The tower is operated by Crown. The tower was built by Sprint but two years ago AT&T installed much larger equip. than the older Sprint equip. Crown has the tower under a long term lease but I still wonder what the future looks like for this cell tower.

Pls. give your best guess.

Thanks, Jim

Hi Jim,

Thank you for your comment. Considering the cell tower was just built two years ago and it has both AT&T and Sprint on the cell tower, I would say you are in good shape and I don’t think the cell tower is going anywhere for years to come. That is my guess without of course reviewing any paper work, location, etc.

All the best,

Nick G. Foster

Crown Castle owns the current T-Mobile site on my property. Is there a chance they will be selling it back to the new T-Mobile or will they just keep trying to get me to let them expand it for free? There is no current Sprint coverage that overlaps my site and all the techs that come out say the site is critical. Have not heard from Crown regarding their proposed expansion in a year.

Hi Tim,

It sounds like you have a great site, so I would not be concerned. I am not aware of Crown Castle selling sites back to T-Mobile and I doubt that would happen in the near future. I would not let Crown Castle expand their site for free, or grant them an option to expand their site. If they want more of your land, you can dictate the price and say yes, or no to their expansion request.

All the best,

Nick G. Foster

This is so hard to figure out. I am a private single tower owner. I have both T-Mobile and Sprint there now. As the merger progressed Sprint kept building the newest 2019 Samsung cell system on my tower. I couldn’t figure out why they would keep building the newest equipment out there on my site , as they will be decommissioning one of them. T-Mobile was building and planning their 600 MHZ panel construction at the same time.. Makes little sense to me. I asked the installation contractors what there prospective was, they indicated the Sprint MMBS was going to Dish. Black dot is still on my tail often. If T-Mobile bails one contract from my tower, they will have to pay a big price to remove all the fiber and panels they constructed. It is in my contract site will be restored to original configuration upon closing. This site covers (2) communities of 20,000, plus traffic on US highway 50. What dows your crystal ball say ? Thank You !

Hi Richard,

Thanks for reaching out with your question. As far as Blackdot, you can ignore them. In regards to T-Mobile and Sprint and if one of your tenants will disappear, it is very possible. It is forecasted that some Sprint sites will migrate to DISH, but not all. If I were in your position I would just wait and see what happens. I would not grant any rent reductions. I would see where the chips fall, if they fall at all.

All the best,

Nick G. Foster

Black dot offering me 150 X the monthly rent for tmobile. What’s the catch there?

Hi Jor,

The catch is you would be selling your T-Mobile lease for cheap. If you want a top of the market offer to purchase your lease, give us a call.

All the best,

Nick G. Foster

Is there maps that show Tower concentrations and grandfathered towers in different areas.

Hi Zafar,

There are no maps that I am aware of that show grandfathered towers. The FCC keeps a database of towers registered with them that is available to the public. You may want to check out their website.

All the best,

Nick G. Foster

I also heard that some of the Sprint Towers ( were there is also a T Mobil tower ) will be saved and utilized for 5G and or other frequencies that require additional real estate .. ??

Hi Nick,

It is possible some of the towers may stay, or they may be transferred over to DISH as part of the merger arrangement. As far as saving towers to utilize 5G, I could only imagine that scenario taking place in an urban environment where the first tower is not sufficient. I can’t imagine that scenario taking place in rural areas.

All the best,

Nick G. Foster

How does this effect an offer I have to build a tower on my prop @ 35051 in Alabama contract was signed approx 1 yr ago for $3100 month no construction has started yet tkx don horton

Hi Don,

I think that the other party you signed the contract with may not be legitimate. As a result they may never intend to build. $3,100.00 per month in rent to lease raw land in Alabama is extremely high. Hopefully I am wrong and you will financially benefit as a result of my incorrect opinion.

All the best,

Nick G. Foster