Considering selling your cell tower lease? You have two main options. One option is to take the sales proceeds in a lump sum payment (similar to selling property). Another option is to take the sales proceeds as installment payments paid over a period of time.

Which Option Is Right For You?

Let’s dive into an example of an offer our client received on July 25, 2017, from a tower company.

Option #1 – Seller will receive a lump sum buyout of $555,000.00

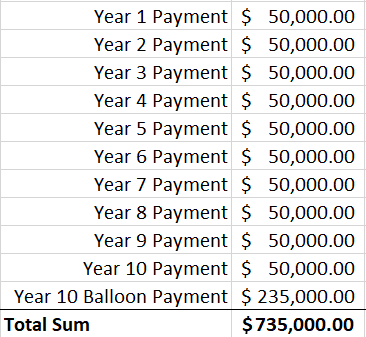

Option #2 – Seller will receive a total sum of $735,000.00 paid out over 10 years in installment payments of $50,000.00 per year and a final balloon payment on year 10 of $235,000.00

At first glance, Option 2 appears to be more lucrative since it is $180,000.00 more than Option 1. However, what we will learn below is that over time due to inflation, Option 2 will actually net the seller less than Option 1.

How Can That Be?

If we look at Option 2 and we pretend that inflation does not exist, then this is what the value of the payment schedule would look like:

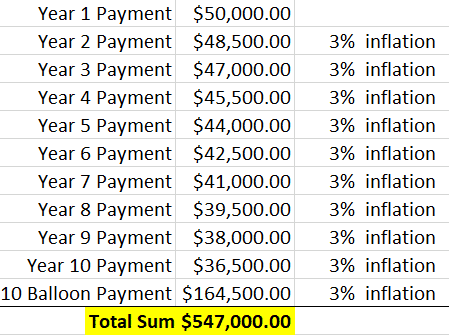

However, Let’s Calculate An Assumed Rate of 3% Annual Inflation

If the seller accepted a 10-year payment and inflation was assumed at 3% per year over the next 10 years, then the seller would actually receive a value that is equal to $8,000.00 less than the lump sum payment.

Are There Other Risks With Installment Buyouts?

Yes, installment buyout offers come with additional risks such as:

If the tenant terminates the lease and rent payments stop to the buyer during the 10 year period – then the installment payments terminate.

If the buyer goes out of business during the next 10 years then the installment payments terminate.

How Can Airwave Advisors Help?

We have closed over $30,000,000.00 in sales transactions. By engaging Airwave Advisors you are hiring experts to help you maximize your return in your transaction.

Call Us Today

(888) 443-5101

Posts That May Interest You:

- Who We Are | Airwave Advisors

- 7 Reasons Why YOU Should Consult A Cell Tower Lease Expert

- Our Competitive Advantage

Disclaimer: Airwave Advisors LLC does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Related Articles

4 Comments

Leave a Comment

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).

Hey, I want to get into cell tower lease business or buy the land for cell tower lease. or I want to buy the cell tower lease business.

Hi Sam,

Your best bet to get into the business is to go work for a site acquisition company.

Good luck,

Nick G. Foster

I live In wa state … I am interested in purchasing of land with active cell tower I’ve been looking on line but really didn’t come across anything in wa state do you have any suggestions?

Hi Jane,

You may want to drive around your market and look for towers in the sky. There is no easy way to find land with cell towers to purchase.

All the best,

Nick G. Foster