Are you considering selling your cell tower lease? You are not alone. We have helped property owners like you find the right answers to their tough cell tower lease buyout questions. To help you get started we want to share with you six things to consider when you are thinking, should I sell my sell tower lease.

1. Immediate Cash vs. Long Term Value

By selling your cell tower lease you typically will receive a lump-sum payment of cash or an installment plan on the lump sum amount. In this article we will not be discussing installment buyouts in detail, however, if you would like to learn more regarding installment buyouts, please read our article “Why Installment Cell Tower Lease Buyouts Net You Less Money“. Regarding the lump sum cash, the value of the money you will receive will be at a discount rate of the potential total lease value.

Example – If your cell tower lease pays you $1,000.00 a month in rent and it escalates at a rate of 3% annually, the potential total lease value over 25 years is $437,511.00 (if the tenant does not terminate the lease over the 25 year period).

If you cash out today, you should receive a minimum buyout purchase price of $120,000.00 (however, Airwave Advisors can obtain an a significantly higher offer for you).

As you can see above there is a large discount a seller takes when accepting a cell tower lease buyout, if they believe in fact that the tenant will not terminate the cell tower lease over the 25 year period.

However, even with this discount, a cell tower lease buyout may still may be a good deal for the following reasons:

2. The Cell Tower Tenant Has The Right To Terminate With 30 Days Notice.

There is no guarantee that your cell tower tenant will be paying you rent twenty five years, or even five years from now. While it is unlikely some of the major tenants will cancel their cell tower leases anytime soon, we have seen carriers decommission entire networks such as Nextel, or entire US markets such as Metro PCS and US Cellular.

Cell tower income is not guaranteed for any amount of time. By taking a cell tower lease buyout you are doing the equivalent of taking your chips off the table and walking out of the casino. You have hedged your risk against a possible termination of your cell tower lease and put money in your pocket.

3. Cell Towers May Not Be Needed In 20 Years Or More.

Analysts predict that we will need cell towers for at least the next five to ten years, however, a disruptive technology could replace the need for cell towers in the near future.

Qualcomm recently developed a technology called LTE Direct which will allow phones to talk to each other, without the need for cell towers. Elon Musk of Tesla and Space X fame is working on a network of thousands of low orbit satellites to deliver the internet to consumers back on earth.

While it does not appear that either technology will be disruptive enough to replace cell towers entirely, the bottom line is the long-term future for hundreds of thousands of cell towers is uncertain.

If a replacement technology is developed to save cell tower lease tenants billions of dollars on cell tower lease rent, you can bet it will be deployed – as fast as possible.

4. You May Not Receive The Full Potential Value Of Your Lease.

Where will you be in ten years, or in twenty-five years? Will you still own your property?

According to the US Census Bureau only 37% of Americans have lived in their homes for 10 or more years.

Many property owners will not be holding the property they own today, ten years or more into the future. If that is the case, it may make sense to sell the cell tower lease now to capture as much of the future rent as possible.

5. How Would A Transaction Affect Your Property Going Forward?

Is your property your residence, an income producing property, or owner-occupied commercial real estate?

Each specific type of property ownership is affected differently with a cell tower lease buyout transaction. Having closed over 100 cell tower lease buyout transactions across every property type imaginable Airwave Advisors is uniquely positioned to help guide you through your cell tower lease buyout transaction.

In the sales documentation will you be structuring the transaction as a lease assignment or granting an easement to the cell tower lease buyout buyer? It is best that you understand the deal structures available to you with a cell tower lease buyout, and what structure would best meet your needs.

6. Are You Using Experienced Representation?

A cell tower lease buyout is a major transaction that will affect your real estate for decades to come. Make sure you have experienced representation on your side to avoid common pitfalls and to ensure you are not leaving any money on the table!

Airwave Advisors has successfully closed over $60,000,000.00 in cell tower lease buyout transactions helping property owners like you. Contact us today to discuss your cell tower lease buyout opportunity.

Have A Cell Tower Lease Question?

Call Us Today

(888) 443-5101

Posts That May Interest You

Related Articles

6 Comments

Leave a Comment

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).

I have a couple lots where maybe cell towers can be located, how can I find out if my locations match the coordinates that cell comapnies need?

Hi Abraham,

To help assist you in your search we have published two articles you may find of value.

Cell Tower Locations | 5 Things You Need To Know (the article includes links directly to top US wireless carriers)

How Do I Get A Cell Tower?

All the best,

Nick G. Foster

Good morning Airwave Advisors,

I have a Client (Dana L. Heideman) who is seeking to monetize his ground (windmill) lease at the Caithness Shepherds Flat. You can see it at https://caithnessshepherdsflat.com. He has a long term lease to Caithness on his 2000 plus acre farm in Ione, OR.

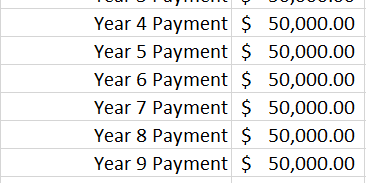

The Client would like to sell his guaranteed lease payments outright just like a lottery winner obtaining a lump-sum cash payment for his lottery winnings in-lieu of waiting 20 plus years to collect the remaining the monthly disbursements of $14,166.66. The $14,166.66 monthly disbursement will increase to $28,333.333 per month in approximately 5.8 plus years.

Dana is a Oregon farmer, and he needs the capital to buy a warehouse and equipment in Long beach, California.

The terms of his ground lease are as follows:

The remaining windmill contract is for a little over 23.2 years.

It can be renewed 2 times and each renewal is for 10 years, totaling to 20 years.

Currently, the Owner gets 2.5% of the revenue for himself which comes to $170,000 per year. In 5 and 2 months the contract payment increases to $340,000 per year.

The contract has already run for 6 years and 10 months.

When the contract completes 12 years, from 13th year on-wards, the payment will automatically go from 2.5% to 5%.

At that time, the receivable will be $340,000 per year.

This payment will continue for the remainder of the term and during the two renewal periods.

Currently, the payment total is as follows:

1) From now to 12 years: (5 years) $170,000 X 5 = $850,000

2) From 13th year to 20th year: $340,000 X 7 = $2,380,000

3) Year 21 to 30: $340,000 X 10 = $3,400,000

4) Year 31 to 40: $340,000 X 10 = $3,400,000

Total worth minimum guaranteed receivable: $10,030,000

I wonder if this is something your firm’s bailiwick, whereby Dana can sell his long-term lease? Thanks in advance!

Kind regards,

Tony Bellenger

Hi Tony,

It was good speaking with you. Good luck with your potential transaction.

All the best,

Nick G. Foster

Yes Mr Foster I have a question it seems like forever but we have a contract with Verison to build a cell tower on our property. But they never let us know anything. We are tired of waiting. What to do.I thought due to the Covid deal I dont know. Someone wassuppose to return our call but never did. Just keep waiting or what? Any help you can share would be great.

Hi Charles,

Unfortunately there is nothing a property owner can do to force Verizon’s hand after a contract is signed. This is why it is of the upmost importance to put language in the cell tower lease agreement stating that if they do not build in say 12 months, the entire agreement expires. If the lease does not have a deadline in the agreement, sometimes I can see these agreements sit with no action on them for years (or sometimes they never build).

All the best,

Nick G. Foster