With the United States Federal Reserve printing money at an unprecedented rate, to save the American economy from the dire financial impacts of the coronavirus, inflation is likely around the corner. Inflation will decrease the value of the dollar your receive from your cell tower lease.

Before we get to your cell tower lease, what is currently going on in the US economy?

- Over the last twelve months the US dollar has lost approximately 10% of its value according the the U.S. Dollar Index (DXY).

- Goldman Sachs has warned that the US dollar is in danger of losing its status as the globe’s reserve currency.

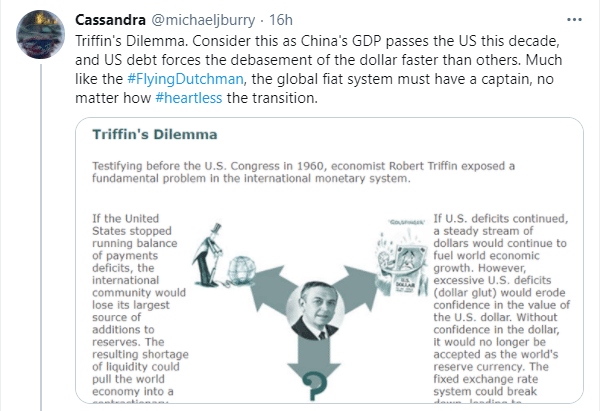

- Legendary American Investor and hedge fund manager Michael Burry of the “Big Short” fame. Best known for foreseeing and profiting from the subprime mortgage crisis. Tweeted over the weekend alluding to China’s Yuan will take the US position as the globe’s reserve currency as well.

With Wall Street Betting Against The US Dollar, Should You?

Unfortunately indicators at this time say yes. There are no indicators, or historical anecdotes, that would point to an example where printing an endless supply of a country’s currency leads to an increase in the value of that currency. As a result, the value of the dollar you receive in rent from your cell tower lease will decrease in value, until the US economy turns back around years from now.

How Can My Cell Tower Lease Protect Against Inflation?

The primary mechanism to increase the value exchanged (rent) in a cell tower lease to keep pace with outside market forces is the rent escalator.

What is a rent escalator?

A rent escalator is language in a cell tower or cell site lease agreement that states the rent will increase by a specified amount at a specified time period. Typically on an annual or term (every five years) basis.

How often should your rent increase and by what amount?

Most new cell tower leases tenants are trying to propose rent escalators that increase every term (or five years). This is a horrible business term to agree to as the property owner loses the compounding effect of an annual rent escalator. In addition, the value of the dollar they receive until the term rent escalator triggers, decreases year-after-year.

Instead traditional wisdom has pointed to the use of an annual rent escalator. Typically around 3% annual. This is based on the average inflation rate in the United States for approximately the last one hundred years.

With the new coronavirus economy’s impending inflation is 3% annual enough?

Possibly 3% annual will not be enough. Keep in mind the US inflation rate once hit a high of 23.70% in June of 1920. In 1974, 1979, and 1980, inflation north of 10% was not uncommon.

As a way to protect yourself against inflation risk, your cell tower lease rent escalator should be “the greater of (i) the increase in the Consumer Price Index (CPI) or (ii) 3% annual”. This way if inflation goes north of 3% annual the value of the dollar your receive in rent is protected against the devaluing of the dollar exceeding 3% due to inflation.

What If I Can’t Change My Lease?

If you have already entered into a lease agreement and it does not expire for many years to come, than there is nothing you can do at this time. Your rent will escalate in accordance with the terms of your lease.

I have recently received some phone calls from property owners who have agreed to long term leases with no rent escalators. Please, please, please, do not make this mistake. If you need any help negotiating your cell tower please, please give us a call at (888) 443-5101.

Related Articles

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).