Your Sprint Tower Lease | Recent Activity

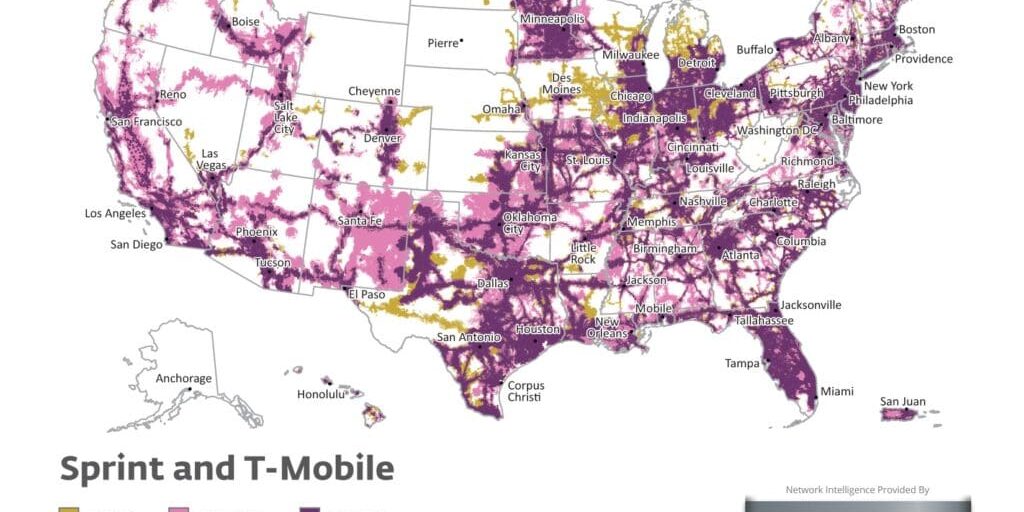

The 3rd largest US carrier is currently upgrading their cell towers with new antennas and auxiliary equipment. While upgrades take place, the parent company of Sprint, Softbank, has come to an agreement to merge with the 3rd largest US carrier, T-Mobile.

Who is Softbank?

Softbank is a company founded in Tokyo in 1981 and currently led by CEO Masayoshi Son. Softbank purchased Sprint in October of 2012 for approximately $20 billion. Softbank also has investments in Uber and WeWork.

1. Sprint Upgrades Present An Opportunity To Increase Rents

Sprint has been contacting thousands of landlords across the nation with requests to upgrade cell towers and cell sites. Often the request comes in the form requesting “consent” or stating Sprint is making “like-for-like antenna swaps”.

Don’t be fooled.

By asking Sprint’s representative asking you to sign consent, they are asking for permission to upgrade for free!

Every letter from Sprint along with all plans should be reviewed by a cell tower lease expert such as Airwave Advisors. Don’t miss your opportunity for more rent.

2. Site Audits Find Free Money

We have successfully collected thousands of dollars in back-rent paid to landlords like you. How did we do it? We perform an audit of T-Mobile’s lease and site configuration.

To the right is a photo of a piece of Sprint’s auxiliary equipment called an RRH unit. This unit was installed on our client’s rooftop without landlord approval. Airwave Advisors identified the breach and our client received back-rent and a future rent increase from Sprint. Could you benefit from additional rent? Have your rooftop cell site audited by Airwave Advisors today!

3. Tread With Caution With Lease Extensions

While a lease extension may sound like a good idea, it is important to remember, lease terms lock YOU – the landlord – in for additional time, not Sprint. Typically, Sprint has an “out” in the lease agreement where they can terminate with only 30 days’ notice. Be wary of any lease extension offer and to sleep well at night, have any offer reviewed by Airwave Advisors.

4. Consider Cashing In On Your Cell Tower Lease

According to analysts, T-Mobile and Sprint must merge or one will fail. It may make good business sense to sell your cell tower lease. Right now, Sprint’s future is uncertain and if you could use an extra $100,000 – $500,000, now may be a good time to sell your cell tower lease. It is a big decision that should not be made without consultation from a cell tower lease expert. Contact us today and we can discuss this opportunity to see if it makes sense for you.

Have A Cell Tower Lease Question?

Call Us At (888) 443-5101

Related Articles

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).