Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.

– Warren Buffett

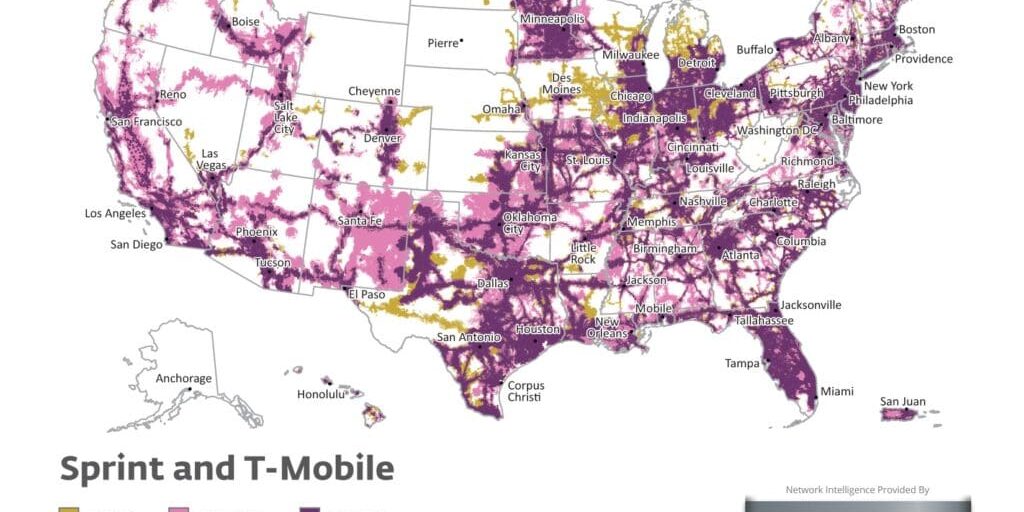

Last week Sprint’s Stock (NYSE: S) hit an all-time low of $3.10, Sprint announced an decline in revenue of 8.6% year-over-year, they lost over $2 billion in free cash flow, and they lost their place as the nations third largest carrier (falling behind T-Mobile). Sprint also replaced their Chief Financial Officer, their Chief Operating Officer, and their Chief Technology Officer. The only executive left with tenure is CEO Marcelo Claure, who came on-board last year in August. What a week!

Sprint’s majority shareholder, Softbank, in reaction to the news, announced they would invest another $5 billion to $10 billion into Sprint, with the goal of boosting investor confidence. Some Wall Street analysts announced now is the time to sell Sprint, not to pour more money into an already sinking ship.

How Did Sprint Perform In 2014?

If we look back to last year, Sprint stock started the year around $10.00 per share, however it lost over 57% of its value during the year closing at just above $4.00 per share. During 2014, Sprint also announced they were decommissioning over 6,000 cell towers and laying off more than 2,000 employees. The last 20 months have been very difficult for the country’s fourth largest carrier, as they fight for market share with the top three carriers.

How Does Sprint’s Recent News Affect My Sprint Cell Tower Lease?

Sprint’s most recent earnings call announced that they have completed their Network Vision project; however, Airwave Advisors is still working on behalf of many of our clients who are still in discussions with Sprint for these upgrades. We believe Sprint landlords will continue to receive communication from Sprint requesting upgrades, and extending soon-to-be expiring leases.

Sprint landlords should also consider Cell Tower Lease Buyouts. While both AT&T and Verizon’s future looks strong, Sprint’s future is rather uncertain. Cell tower lease buyouts present Sprint landlord’s the opportunity to receive a lump sum payment equal to more than ten years of today’s rent value.

To secure the highest offer with your rent increase, lease extension, or cell tower lease buyout opportunity, contact Airwave Advisors today!

Call Us Today

(888) 443-5101

Posts That May Interest You

Related Articles

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).