With cell tower lease buyouts many investors want an easement to go along with the assignment of the cell tower lease. Easements vary in the length of time from perpetual (forever), to a fixed period of time (such as 10 years).

Typically the longer amount of time a seller is willing to sell their cell tower lease for, the more money they will receive from a buyer. Therefore a perpetual easement, an easement for 99 years, or an easement for 55 years, is commonplace to receive a top sales price in the market.

1. Should You Pursue A Perpetual Easement Or A Fixed Term?

It depends. Many of our clients are looking for the maximum purchase price when selling their cell tower lease, so they will grant the highest term to the buyer for the highest sales price. Other clients like the idea of having the lease rights revert back to the property owner sometime in the future. Those clients will pursue a 15, 25, or 30 year deal. The time frame of the transaction is all dependent on what makes the most sense for you – the seller.

2. Do Taxes Play A Factor With Easements?

Airwave Advisors® is not a qualified tax advisor, and we recommend you seek qualified tax advice from a trusted tax advisor when pursuing a cell tower lease buyout transaction. We have been told that perpetual, or 99 year easements, often qualify for capital gains tax (as opposed to the higher ordinary income tax the property owner is currently paying), however, do not consider this statement regarding taxes valid advice, please confirm with a qualified tax advisor.

3. What About 1031 Exchanges?

Depending on the current land use of your property, you can likely roll the cell tower lease buyout sales proceeds into a new property of similar, or like-kind, using Internal Revenue Code Section 1031(a)(1). Specifically this language states:

No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.

3. I Still Have Questions, How Can You Help?

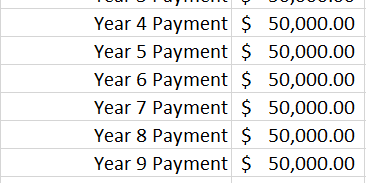

Give us a call today. We have closed over $50,000,000.00 in cell tower lease buyouts, tailoring every transaction to meet the need of the seller. Perpetual easements, 99 years, 30 years, almost any amount of time can be exchanged in return for a lump sum payment to the seller. This is a unique transaction where you can greatly benefit with the help of a cell tower lease expert.

Call Us Today

(888) 443-5101

Posts That May Interest You

- Who We Are | Airwave Advisors

- 7 Reasons Why YOU Should Consult A Cell Tower Lease Expert

- Our Competitive Advantage

Related Articles

2 Comments

Leave a Comment

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).

I have a piece of property in West Palm Beach and the light industrial area that could have a cell tower constructed on it could you help me in finding a potential person to rent my property to build it? Thank you Kirk Angelocci 561 7180370

Hi Kirk,

Please check out our article “Cell Tower Locations“. I think you will find a lot of useful information in there.

All the best,

Nick G. Foster